Payroll tax estimator

It comprises the following components. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

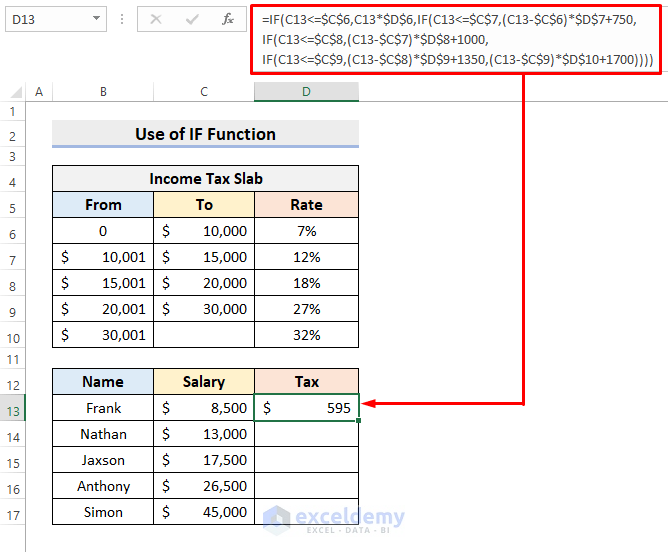

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

If this describes your situation type in your employees gross.

. Payroll Taxes Taxes Rate Annual Max. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Gross Pay Calculator Plug in the amount of money youd like to take home. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

This component of the Payroll tax is withheld and forms a revenue source for the Federal. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck. If your monthly paycheck is 6000 372 goes to Social Security and.

Summarize deductions retirement savings required taxes and more. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Estimate your tax refund with HR Blocks free income tax calculator. View FSA Calculator A. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that.

Thats where our paycheck calculator comes in. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. You can enter your current payroll information and deductions and.

Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. The calculator includes options for estimating Federal Social Security and Medicare Tax. Computes federal and state tax.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. This number is the gross pay per pay period. It only takes a few seconds to.

Your household income location filing status and number of personal. Get an accurate picture of the employees gross pay. Components of Payroll Tax.

Subtract any deductions and. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

How To Calculate 2019 Federal Income Withhold Manually

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

Income Tax Slabs Tax Liability Comparison Between 2020 And 2019 Calculator Getmoneyrich

Income Tax Formula Excel University

Download Income Tax Calculator Free For Pc Ccm

How To Calculate Federal Income Tax

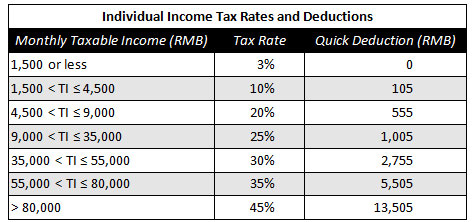

How To Calculate Foreigner S Income Tax In China China Admissions

Ethiopian Income Tax Calculator 10 0 3 Free Download

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How To Calculate Income Tax On Salary With Example

Payroll Tax Deductions Business Queensland

How To Calculate Income Tax In Excel Using If Function With Easy Steps

How To Calculate Income Tax On Salary With Example

Inkwiry Federal Income Tax Brackets

Income Tax Slab 2020 21 Old Tax Regime Or New One Which Is More Beneficial The Financial Express

Payroll Tax Calculator For Employers Gusto

Calculating Individual Income Tax On Annual Bonus In China China Briefing News